As an international student, online banking is a highly efficient way to manage your finances. Nearly all your daily banking needs can be met without visiting a bank in person. Virtual banks provide unmatched convenience, allowing you to handle your accounts from anywhere—home, office, or on the go. In Canada, online banks, often called virtual banks, offer services such as chequing and savings accounts, transfers, investments, mortgages, and even bill payments and loans. This blog covers the top online banks in Canada for 2024, helping you compare fees, features, and interest rates to find the best fit for your needs. Opening an account is simple, and you will receive a debit card and mobile app access for 24/7 control over your money.

Top-Rated Online Banks in Canada for 2024

In 2024, the best online banks in Canada continue to stand out for their convenience, innovative services, and customer satisfaction. These digital banks provide fee-free accounts, competitive interest rates, and advanced digital tools, making banking easier and more accessible for Canadians.

KOHO: The Leading Virtual Bank in Canada

KOHO Bank provides a top-tier interest-earning chequing account with direct deposit and a prepaid card that offers 1% cash back on select categories. Their optional credit-building tool can help enhance your credit score, and KOHO Bank also provides an impressive 5% interest on account balances.

The mobile app makes budgeting easier by tracking your spending and includes a RoundUp feature that automatically transfers small changes into your savings account. KOHO Bank also provides interest-free overdraft protection, and its premium plans include one complimentary international ATM withdrawal per month.

KOHO Bank Benefits:

-

- Cashback prepaid card

- Unlimited free e-Transfers

- Zero-interest overdraft protection

- Earn interest on account balances

KOHO Bank Drawbacks

-

- No FX fee waivers unless on Extra or Everything plans

- No free ATM network

- Lacks international money transfer options

KOHO Bank is a great choice because it offers high interest rates on account balances and is an uncommon credit builder credit card. Furthermore, the app’s ability to track spending and account balance improves financial management, making KOHO Bank an interesting and easy-to-use option.

Neo Financial: Leading All-in-One Financial Solution

Neo Financial is a versatile Canadian fintech offering a range of zero-fee financial tools, including the Neo Everyday account and card, which features budgeting features, bill payment options, and credit-building support. The Neo Money card is a key benefit, which provides an average of 5% cash back on purchases and 1% interest on account balances (rates may vary). Neo also offers a no-fee cashback credit card and a secured card to help improve credit.

As a digital-first platform, Neo is ideal for those managing finances online. While paper statements incur fees, the app offers tools for tracking rewards, categorising spending, and comparing monthly expenses. With no physical branches, customer service is available online, by phone, or via live chat from 7 AM to 8 PM MT.

Neo Financial Benefits

-

- Free Neo Money™ cashback card

- Free everyday transfers

- No monthly maintenance fees

- Earns 1% interest on balances

Neo Financial Drawbacks

-

- Customer service isn’t 24/7

- 2.5% foreign transaction fee

- No multi-currency support

Neo Financial is an excellent choice for Canadians who prefer to manage their finances digitally. With the Neo Everyday account, users can enjoy fee-free transactions, including transfers and ATM withdrawals, while exploring a comprehensive suite of financial services through their mobile app.

Tangerine Bank: Top Choice for Mortgages and Loans

Tangerine, a digital banking arm of Scotiabank, offers no-fee chequing and savings accounts. Instead of traditional branches, Tangerine Bank operates ‘cafes’ in Toronto, Vancouver, Calgary, and Montreal, where customers can get financial advice while enjoying coffee. Tangerine’s range of products includes loans, mortgages, and a low-cost investment platform to help build long-term wealth. Offering up to 1% interest than traditional banks—Tangerine’s savings accounts have even better rates with certain holding periods. Additionally, Tangerine Bank provides a cashback credit card, ideal for those seeking practical rewards.

Tangerine Bank Benefits

-

- Backed by Scotiabank, ensuring account security

- Supports both cash deposits and cheque services

- Access to 44,000 fee-free ATMs globally through Scotiabank’s Global ATM Alliance

- Chequing account interest rates of 0.1%, with savings rates up to 1%

Tangerine Bank Drawbacks

-

- International transfers via Interac e-Transfer come with higher fees

- Foreign transactions incur a 2.5% fee per transaction

Tangerine’s elaborate suite of online banking services extends beyond chequing and savings to include investments, loans, and credit options. Known for its award-winning customer service, Tangerine Bank is one of Canada’s most complete virtual banks, making it a highly recommended choice for digital banking.

EQ Bank: Top Choice for Online Savings

EQ Bank, like Tangerine, is a fully online bank available 24/7. However, it is better suited as a high-yield savings account to complement a separate primary chequing account. This is because EQ Bank does not provide a debit card or access to ATMs. With EQ Bank’s virtual account, you can pay bills and transfer funds while benefiting from their top-tier savings interest rates, which range between 1.25% and 2%. However, it isn’t intended for everyday transactions like a chequing account.

EQ Bank Benefits

-

- High-interest virtual savings account

- Ability to link with your Equitable Bank account

- Free electronic funds transfers (EFTs)

- Customer support is available daily from 8 am to midnight (EST)

EQ Bank Drawbacks

-

- No chequing account or credit card option

- Lacks a debit card and ATM withdrawal access

- Interac e-Transfer for international transfers, but not the most cost-effective

If you already hold an account with Equitable Bank, EQ Bank could be a convenient addition to your financial toolkit. Even if you choose another online bank like Tangerine Bank for everyday transactions, EQ Bank’s savings features make it a solid supplement to any financial plan.

Simplii Financial: Free ATM Access

Simplii Financial, CIBC’s digital banking division, offers a broad range of banking products and services, including chequing accounts, GICs, mutual funds, RRSPs, and TFSAs. Users have described the mobile app, available on Android and iOS, as straightforward yet effective. One of Simplii’s standout features is its integration with CIBC’s extensive ABM network, offering one of Canada’s largest ATM access points.

Advantages of Simplii Financial

-

- No-fee chequing account and interest-earning savings account

- Availability of cashback credit cards

- Access to various loan products, including personal loans

Disadvantages of Simplii Financial

-

- Service not available in Quebec

- Higher fees for international Interac e-transfers

No review of Canada’s online banking landscape would be complete without Simplii Financial. Offering a wide range of financial products accessible entirely online, Simplii provides a convenient alternative to traditional banks. While its app is simple, it still delivers a reliable and effective banking experience.

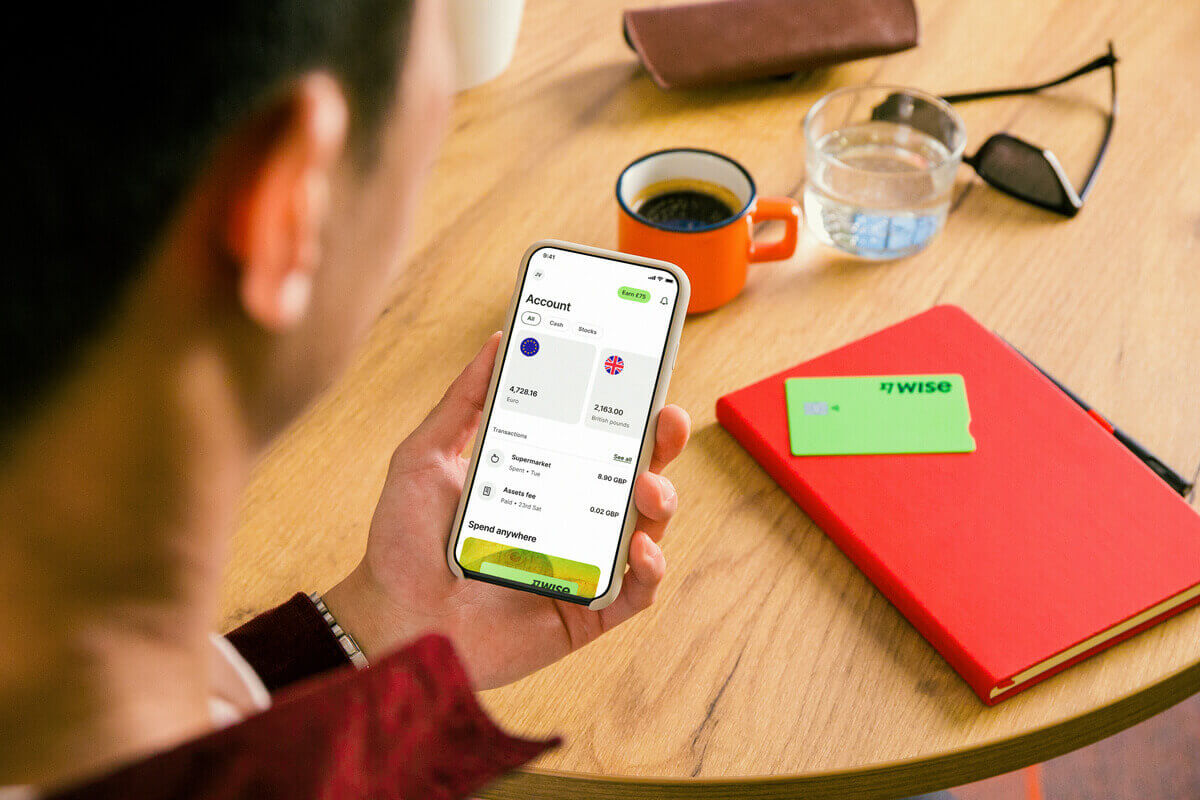

Wise Bank: Top Multi-Currency Account

Wise Bank is widely recognised for providing some of the most affordable international transfers to and from Canada. They also offer the versatile Wise Multi-Currency Account, which equips you with Canadian banking details and account details from nine other countries. With this feature, you can easily use your Canadian bank details to receive payments from a Canadian employer, such as your paycheck. This account is ideal for travellers and those making foreign transactions. It allows you to hold and manage over 50 different currencies, accessible via the Wise Bank debit card or their intuitive mobile app.

Wise Bank Benefits

-

- Bank account details in up to 10 different currencies

- Hold and manage funds in 50+ currencies

- Send money to over 80 countries

- Some of the most competitive money transfer fees in the market

- Transparent and accessible pricing

- Transfers at mid-market exchange rates

- Wise Bank debit card helps avoid foreign transaction fees

- No setup fees or monthly charges

Wise Bank Drawbacks

-

- No support for cash or cheque payments

- Overdrafts and loans not offered

- Negative interest rates on large Euro balances

- No interest earned on account holdings

- Fees apply for topping up the account via debit or credit card

- Limits on fee-free international ATM withdrawals

Wise ranks among the top online multi-currency accounts globally, including Canada. Whether you are looking for an alternative to Interac e-Transfers or need a reliable way to spend money internationally, the Wise Multi-Currency Account is a solid choice for travellers, online shoppers, and Canadian expats.

Motusbank: Top Credit Union Virtual Account

Motusbank is not supported by one of Canada’s big five banks but by Meridian Credit Union, the country’s second-largest credit union. Like other virtual banks mentioned, it offers no-fee chequing accounts, unlimited domestic transactions, and Interac e-Transfer access.

Motusbank Pros

-

- Trusted and federally regulated online bank

- Competitive high-interest rates on savings

- Access to 43,000 ATMs across North America

Motusbank Cons

-

- It does not offer credit cards

- Interac e-Transfers are available for international transfers but aren’t the cheapest option.

Motusbank’s savings accounts boast impressive interest rates that often outshine larger Canadian online banks. However, it lacks credit card offerings, and its selection of financial products is somewhat limited. Still, if you prefer a more community-focused approach through Ontario-based Meridian Credit Union, Motusbank provides full control over your finances with 24/7 online banking.

Conclusion

In the ever-evolving landscape of Canadian banking, online-only institutions have emerged as strong contenders, offering a blend of convenience, competitive rates, and minimal fees. The best online banks in Canada depend on your needs, preferences, and financial goals. From zero monthly fees to high-interest savings options, cashback rewards, and robust financial management tools, these banks are reshaping how Canadians manage their money. Whether looking for high savings returns, cashback options, or smooth, fee-free banking, the best online banks in Canada deliver on multiple fronts. They give you control over your finances without the hassle of traditional branches. As digital banking continues to evolve, finding the right online-only service tailored to your needs has never been more rewarding.

You May Also Read :

|

Guide To Credit Unions in Canada |

|

|

Explore Credit Score in Canada Scale |

|

|

What is FHSA in Canada |

|

|

Understand Escrow Account |

|

|

Know The First Home Savings Account |

Frequently Asked Questions (FAQs)

EQ Bank is considered as Canada's top online bank with its no-fee savings and joint accounts, TFSA and RRSP savings options, excellent customer support, and cutting-edge banking technology. Offering some of the highest interest rates on the market, EQ Bank continues to lead the way in digital banking.

EQ Bank and Tangerine Bank are popular Canadian online banks offering no-fee accounts for chequing and savings.

Tangerine Bank and Simplii Financial are among the easiest banks in Canada to open an account with online. They offer a quick and straightforward digital sign-up process.

Scotiabank is Canada's most globally connected bank, operating over 2,000 branches and offices across 50 countries. With a history of international operations spanning over a century, it has established a strong global presence. What is the best online bank in Canada in 2024?

Which online Canadian bank has no fees?

What is the easiest bank in Canada to open online?

Which international bank is best in Canada?