Small business insurance policy is a multifaceted phrase, encompassing various policies that alleviate small business owners’ risks. This policy tends to cover the costs of any unprecedented action that might come in the way of business owners.

There are many business owners who feel skeptical about insurance plans their business should invest in. However, a successful business plan is a result of general, professional, and cyber liability insurance.

Below are the four common policies that are incorporated in any Canadian business insurance plan:

Below are the four common policies that incorporated

-

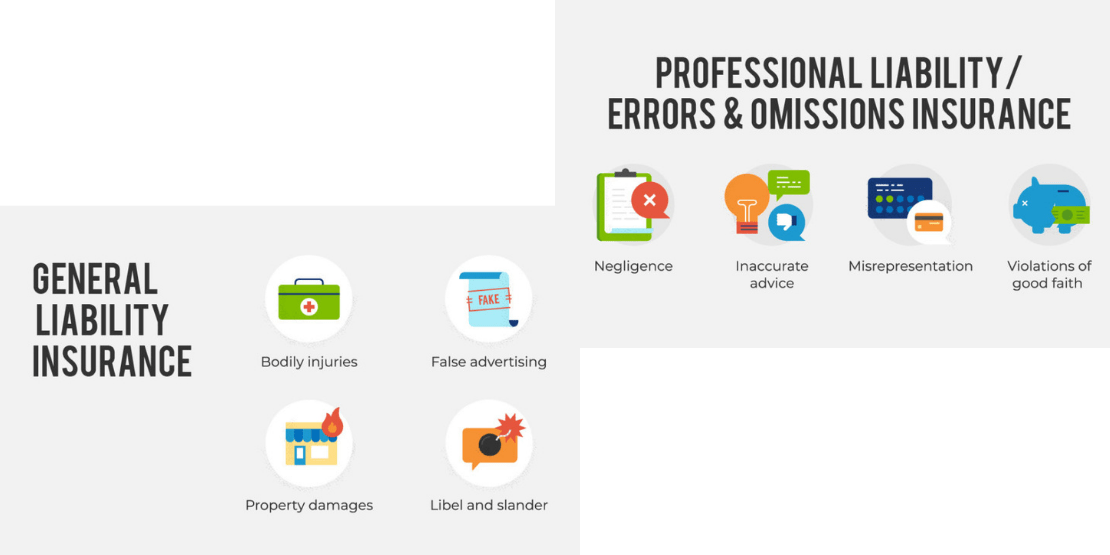

General Liability small business insurance

Costs like legal fees, out-of-court settlements, and damage rewards are pinned under general liability insurance. This insurance policy covers the legal aspects related to slander or libel. This includes property damage or any bodily injury that might have taken place in your professional radii. For example, A customer in your shop slips and falls, they are then liable to sue you for damages. A general liability policy of this kind can cover any damages or claims.

-

Cybersecurity Insurance

This insurance policy plays the role of shielding your small business from any cyber threat lawsuits. This comes in handy when any hacker makes an attempt to access your organization’s database and steals sensitive information. This can include credit card numbers, the company’s data, and statistics. Cybersecurity insurance then pays an amount to the injured parties in the form of compensation. This policy is also supposed to manage any resulting legalities in the form of technical insurance.

-

Professional Liability Insurance

This small business insurance covers the funds for out-of-court settlements, damage awards, and legal fees for your dissimulation behavior or any misrepresentative services. This primarily shells the case where you come out to be incompetent in providing your services to the client and ultimately result in a financial loss. You are liable to be sued under these circumstances, but this policy prevents that from happening.

-

Content’s Insurance

This small business insurance policy is subjected to business thefts, destruction, or damage. The elements covered by this insurance include any furniture, tool, or amenity operational in your business. It provides compensation to replace or repair the damaged entity. This way, you won’t be vulnerable to sudden payments.

Some organizations also have their external resources covered. These might include their building, inventory, or even their business interruptions. The foundation of the company primarily determines the subjective risks.

Why does one need a small business insurance policy?

Opting for a commercial insurance policy is to address the specific risks that a business might be vulnerable to. There is substantial bandwidth for multiple insurance coverages that are available to business owners. The small business owners can then align their needs to the insurance policy and work accordingly. While opting for your business coverages, make sure to pin down the range of operations that might need protection. These might include the following:

- Customers and Employees

- The typology of work that you are doing

- The equipment and property

- Your physical premises

- Intellectual property

It is also important to note that the coverage is a variable according to the expansion and type of your business, they require different kinds of insurance policies to run in tandem.

Is the insurance even required?

As an avid business owner, you must question yourself about the necessity of business insurance. There are multiple options when it comes to a small business insurance policy that is available to various business owners. These situations range from colossal disasters to lawsuits against the organization.

In every other state, there is a specific insurance amount that is withheld for employees operating under your business. For example, The workers’ compensation insurance. The prominence of a small insurance policy becomes worthwhile because of the benefits it comes with. A commercial insurance policy covers all risks including lost wages, theft, and damage. In case, you do not have a policy attached to your business, the costs may come out of your pocket and lead to financial disturbance.

Business insurance is basically a tool for small business owners who use these as assets in order to cover any non-anticipated event. Depending upon the circumstances of your business, an owner might need disability insurance. If you do have employees, then most states would appreciate your possession of unemployment insurance and workers’ compensation.

Worker’s compensation is a financial stilt for the employees, who might be unable to work due to any illness or any occupational hazard. This allows the company to cover the medical costs of the worker under workers’ compensation insurance. Unemployment insurance is another beneficial policy for workers who are being superseded via no fault of their own.

Should you be getting a small business insurance policy?

Make sure to execute a detailed analysis of your business model and then deduce the need of getting an insurance plan. Make sure to calculate the expenses and analyze the affordability of all the funds including the legal fees, and damage rewards. These uninvited costs could puncture your financial charts and in order to maintain legitimate coverage, small business policies could be beneficial. Make sure to mark all the salient calculations including the repair and replacement of your tools.

If the landlords and clients do not require any sort of commercial insurance, the proper coverage would stay in the “condemning” category. The financial imbalance would affect the company and the career of an individual accordingly.

When does commercial insurance become important?

Insurance is a meticulous choice to make for any small business owner. Although Canadian laws do not mandate a business insurance policy, possessing one would turn out to be profitable for you. Canadian business insurance provides the liberty to a business owner to rely on the policy and not overestimate the chances of facing a financial bump.

Suppose you are a company that delivers furniture to other interior designing firms. You would rent a workshop to make all the furniture and the cost of marketing would also add with time. These sources would definitely require you to be insured and sealed from the other end.

While if you are uninsured, you won’t possess the money to pay for the relief, which might lead to a lawsuit. This is where the professional liability policy would help to save your small business.

There are many other likely scenarios where you might land up in a financial puddle and would need money on the go. Having an insurance policy would help in situations like these. Now, although the Canadian laws do not mandate any small business insurance policies, keeping one would shield you from any unsolicited situation.

How much does business insurance cost?

The initial policy that most business owners require is general liability insurance, which is not only the cheapest but also one of the most essential policies. In the analysis of 28,000 small business owners’ commercial insurance policies, the median cost comes out to be CAD42 per month or CAD500 per year for general liability insurance.

The median cost of a Business Owner’s Policy (BOP) bundle, which includes general liability insurance along with property coverage, comes out to be CAD636 per year and CAD53 per month.

Conclusion

A Canadian business insurance policy is not mandatory under Canadian law, but having one would benefit you. Protecting the business you’ve built is a priority. Make sure to communicate with an advisor, who can guide you in picking the right insurance policy.

You May Also Read

FAQs

Working with clients, landlords, customers, and other stakeholders requires you to possess legitimate business insurance. However, the possession of business insurance is not mandatory in Canada.

One of the main risks to operating a business without an insurance plan is that you might end up losing all your funds without any cover. The possibility of losing money won’t be backed up by a compensating damage repair amount, and you won’t be able to trade with the liberty of solely growing your business.

Small businesses can be a crucial bet to play and there is no question that small businesses need some backup protection money in case of an unprecedented data breach. Insurance policies are crucial to have since they can reimburse you for losses and natural disasters.

Business insurance covers businesses from any anticipated financial losses or damage that might have occurred during a regular course of action. The policyholder is responsible for covering all the risks that pertain to the employees, property damage, and legal liabilities. Such incidents and actions can lead to major drawbacks in the business.

Any business needs to possess general liability in order to sign the contracts, protect you from the claims, and rent office space. There is general liability and insurance available separately. These attributes are part of any insurance policy bundle.

Every business owner needs to have an insurance plan based on the size of their establishment. Having insurance plans can help in times of crisis and prevent financial upheaval.