Best Mortgage Rates Toronto

When you want to buy a home in Toronto, finding the best mortgage rates Toronto can save you a lot of money in the long run. Toronto, one of Canada’s biggest housing markets, offers a

Maximum 4 project can be compared at one go.

Canada is a beautiful country that is well-positioned and doing great on global surveys of progress, safety, and quality of life. The country reflects economic and political safety along with a good job market, which is among the major reasons why people wish to settle there for a lifetime. Buying, moving, or selling your property in Canada has become a concern for both natives and expats. Let's delve into all the real estate details, from the tax on buying a house to the tax on utility bill accounts, and so on.

You can utilize the safe self-service Property Tax Lookup feature to upgrade your mail address to reissue your utility bill and property tax. It is quick, convenient, and easy! Enter your property tax statement or tax bill details and log-in to the Lookup of Property Tax, submitting the documents detailed below.

Type your email id in order to raise a request for the alteration of the mail address.

Take a note: You can’t use this facility to change the property ownership or to notify about ownership alteration to the city. Do you own a newly built property and get an extra or neglected tax bill? Send a fax, mail, or personally deliver your request of mail address alteration. At this time, new properties cannot be addressed for online mailing address changes.

By adding the information below, you can also amend you mail id:

Put Forward Your Request Via Fax or Mail Toronto City Services of Revenue, Account Administration PO: Box 4300, STN A Toronto - ON M5W 3B5 Fax Number: 416-696-3640 In case you are an owner of the property then you can even add an agent or tenant to get a utility bill. In case you subscribe to electronic billing then modification in your utility or tax account may impact how you get your bill of electricity.

Approach your lawyer to obtain a utility and tax certificate which will provide you,

In case you are a current landlord and do not know about the upcoming tax installments, penalties, and due dates of utility bills, interest is still due when the payment is received after the due date.

Submit the ownership details for the property tax account by providing a letter from a lawyer that contains the below information.

Post updating your ownership details, you’ll receive the account statement of the property tax via mail which concludes the fee amount of ownership change. Put forward your request via mail or fax Toronto City Services of Revenue, Account Administration Post Office: Box 4300, STN A Toronto - ON M5W 3B5 Fax Number: 416-696-3640

Updating customer details along with the account details over bills. At the time of payment, you are required to update the most recent bill or statement.

|  |

In case you do an online or telephone payments and have lately moved, purchased, or sold, always confirm to amend your most recent assessment roll no. and account of utility via your financial organization and your client no. in case you fail to update these details:

If you have recently bought a residence and are estimating what property taxes are payable annually, refer to the adjustment statement in the residence purchase papers, or you can even discuss it with your lawyer.

Most of the property owners' utility bills consist of wastewater, water consumption, and fees for solid waste, charged in a 4th month cycle and three times annually.

Metres are installed inside the premises; most water metres carry a conveyor that sends the details of water use to a safe unit that collects the data for administration and billing.

Solid waste fees are included in the bills of utility regardless of whether you live on the residence or it is vacant.The solid waste fees is based on the size of the waste bin at the residence whilst sale (large, medium, small, extra-large) and are allocated to the residence until the new landlord requests a different size in the bin.Once your bins are delivered to the property, appropriate fees will be imposed if a request is made to modify a bin's size.

It is advised that you verify the numbers of your current bin(s) and match them to the data on your utility statement when you receive your first bill. In case there are any questions, please call 311.

Making a service request will allow you to opt out of rubbish collection and request that the blue, black, and green bins be withdrawn from the residence if you have purchased a property that will be vacant.

The landlords of the newly-built residences are only eligible to make payments with their account of tax once they receive the final bill of tax. This happens post the city gets the assessment information of the property via a MPAC (Municipal Property Assessment Corporation) and occupant information has emerged.

In case your name displays incorrectly on the bill as a result of a typo on your utility or property tax bill, simply contact the inquiry agency to get it corrected.

Send a letter via mail to General Correspondence at https://www.toronto.ca/services-payments/property-taxes-utilities/contact-us/?accordion=general-property-tax-&-utility-inquiries

In the event that you do not own the property, you are required to finalise your utility account.

You need to approach a representative of customer service, in order to ask for a final water metre read, for which you need to provide the following:

Note: The last utility bill concludes with the final or special reading fee.

In case you are participating in the Pre-approved Utility Bill Payment (PUP) programme, your enrollment in the programme is cancelled once your final metre read has been completed. Regular utility bills will be sent to you, and you must pay them by the due date using another method of payment.

A final metre read may be requested by tenants who are engaged in the specified programme of mailing (i.e., whose name appears on the account of utility and who receive and pay utility bills). When you ask for a final metre reading, you must include the date you plan to move out as well as the other details listed above.

If you do not own the property but are still receiving tax bills, submit the tax bills back to Toronto together with the relevant paperwork mentioned in the requirements for reporting ownership information. Please get in touch with a customer service representative if you have any questions.

Refer to the Statement of Adjustments in the property acquisition documents or speak with your attorney if you recently sold a residence and are attempting to figure out how much you owe in property taxes. If you are selling a house on behalf of someone else, please refer to the power of attorney, estate executor, or letter of authorization.

Refer to the Statement of Adjustments in the property acquisition documents or speak with your attorney if you have sold a property in recent time and are attempting to figure out how much property taxes you have to pay.

The property, not the resident or owner, is given the number from the assessment list and the account number for utilities. Use the account number of the utility along with the number of clients from your latest bill and the assessment roll number to pay your bills.

Make sure the account number has been updated or erased in case you have formerly paid your bill of utility or house tax using internet banking. Your account number will alter if you relocate to a new home. Any fees associated with late or misdirected payments are your responsibility.

When selling your property, you must give the city written notice if you choose to call off your participation in the pre-approved bill of utility payment programme or the pre-authorized tax payment programme.

In case you are selling a house on behalf of someone else, please refer to the estate executor or power of attorney.

Every year, in the middle to end of November, the Municipal Property Assessment Corporation (MPAC) sends the return of the roll of assessment, along with the property assessment, to the City of Toronto. The city creates the last and interim property tax bills using this property information from MPAC. Your tax bill's name(s) and postal address are upgraded by the name(s), the city name, which is listed under "Assessed Owner" is taken from the assessment roll's annual return. The former owner may be listed in the "Assessed Owner" field of your property tax bill levy in 2023. If you bought the property after October 31, 2022. You will see your name listed on your property tax bills levied in 2024 as the "Assessed Owner." The owners of property can contact MPAC at 1-866-296-6722 or go to the website of MPAC in order to access information about their property. Opens a new window to access the online resource; separate window.AboutMyProperty opens a new window to allow you to view the information stored about your property.

The owner of property, or the person(s) designated as an executor or power of attorney, must provide the following in order to fulfil a mailing address change request and/or have information regarding tax/utility accounts released to an authorised agent:

You must submit a Letter of Authorization with the following information in order to release tax or utility account information to an authorized agent:

Send your request through mail or fax Account Administration Toronto Services of Revenue Post Office: Box 4300, STN A Toronto, ON M5W 3B5 Fax Number: 416-696-3640

You can follow the steps to alter your name on your utility or tax account. Simply put your request forward along with a certificate of marriage or a name change certificate.

Put forward your request through fax or mail: Toronto City Services of Revenue Account Administration Post Office: Box 4300, STN A Toronto, ON M5W 3B5 Fax Number - 416-696-3640

In a Nutshell If you want to move to Canada and buy or sell property, you must be aware of the specifics. Above, we have explained all the pre and post steps related to tax on new property, property tax lookup Toronto Utility Accounts, and furthermore to help you take an educated step.

You can get a temporary Canadian residency, but you need to fit the immigration criteria if you are willing to become a permanent resident or want to extend your stay.

Canada positions itself as a perfect destination for numerous foreign entrepreneurs, start-ups, and investors. Due to this reason, the Canadian government has created multiple business visa pathways via which foreign residents can obtain permanent residence in Canada.

No citizenship or residency is required to own a house in Canada, as you can buy a property with temporary Canadian citizenship.

It’s not mandatory to have a job offer to move to Canada, but with insufficient funds to support yourself and your family, you might need one. For a job offer, you must be eligible for either the Federal Skilled Trades Programme or the Federal Skilled Worker Programme.

When you want to buy a home in Toronto, finding the best mortgage rates Toronto can save you a lot of money in the long run. Toronto, one of Canada’s biggest housing markets, offers a

The MAT (Municipal Accommodation Tax) is imposed on short-term rentals in Toronto. As a registered operator of short-term rentals, you need to assemble and put off 4 percent as a MAT on total rentals. As

Pre-Authorised Payment ProgramsTo enrol in a Pre-Authorised Tax Payment Program (PTP), one must complete a Pre-Authorised Tax Application form. By enrolling in the program, the property tax bill payments are automatically deducted from your bank

For a government of any country, property taxes are one of the most practical ways to earn revenue. Every homeowner in Canada is entitled to pay their share of property tax. The income collected through

The Canadian housing market 2425 offers a variety of attractive locations for real estate investment, each with unique characteristics and

Do you also encounter difficulties understanding seller's permits and resale certificates? If yes, then worry not, as this is common

Purchasing and Constructing land in Ontario can be a daunting task. You never know what might happen. There are numerous

Canada's most notable and famous city, Toronto. Any individual planning to reside in Canada, this city is a preferred choice.

In Toronto, property taxes and Toronto utility bills can be paid online through the City of Toronto's website or in

When it comes to Toronto, property transfer tax takes center stage during property transactions, encompassing both sales and purchases, even

Property taxes are charges or levies imposed by the local government for upkeep, infrastructure improvement, and educational purposes. They are

By requiring building inspections for permits and demolitions, as well as by looking into emergency orders and work done without

A Conditional Permit (CP) is a building permit issued where all the approvals were not received. CPs are used for

Since so long ago, Toronto, a city of towering buildings and legendary real estate masterpieces, has served its residents. When

Multi-tenant housing is when four or more people bunk together in one house and share the washroom and the kitchen

A tax is a mandatory financial charge or some different type of levy imposed on the taxpayer by a government

Toronto Property tax refers to the fee that residents of a country owe to their government. The amount of the

All properties in Ontario must be valued and assigned a classification by the Municipal Property Assessments Corporation (MPAC) Opens in

The Sign By-law, which lays out rules for signs used for business identification or promotional reasons, was passed by the

Toronto, the largest city in Canada, is situated on the northwestern shore of Lake Ontario. It is home to a

By requiring building inspection permits and demolitions for building, as well as by looking into emergency orders and work done

One of the most crucial steps in the building process is obtaining a building permit. A building permit is a

You must have seen organisations that choose to invest in real estate properties. Do you know what exactly the framework

Shifting is a global issue, especially for tenants with a travelling professional who needs to find a new settlement within

Are you dreaming of owning a home? A place to call your own? Buying a home is one of life’s biggest milestones, a mix of…

Gentrification in Canada stands for a term that captures the transformation of a neighbourhood through the influx of more affluent residents and businesses. It can…

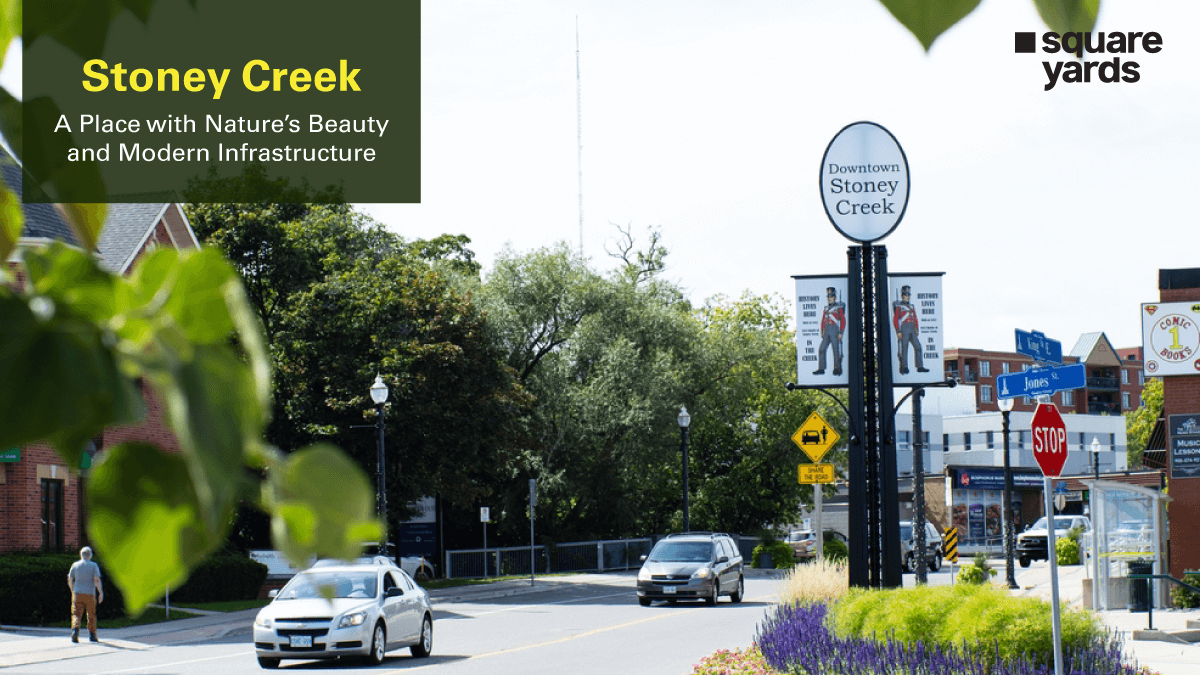

Tucked along the shimmering shores of Lake Ontario, Stoney Creek is where history whispers through scenic trails. Once a quiet village and now part of…

Are you a new condo owner? It must be an exciting step to have your own space. However, are you aware of the financial responsibilities…

If you're a landlord in Ontario, then you should know about the tenant eviction process. It is essential for managing your property effectively and staying…

Every trip to Montreal is considered complete with exploring the extraordinary underground city, called RESO Montreal Canada. It’s like a secret city under the streets,…

Burlington, Ontario, is where small-town charm meets urban energy, and every day feels like a page from your favourite novel. Burlington, located along the shores…

Are you ready to buy a home in Canada but torn between the appeal of brand-new construction vs resale homes property? It’s a big decision,…

When it comes to making home improvements, one of the first questions many homeowners have is, "When do I need a building permit?" It's a…

In the world of kitchen design, an island isn't just a stylish centrepiece. It's a pivotal element that can significantly enhance the functionality and flow…

Norfolk County is a treasure in Ontario, recognised for its breath-taking landscapes and rich past. It has beautiful beaches, charming villages, and green countryside, making…

Feeling trapped under the weight of multiple debts? Credit card balances, car loans, and personal loans piling up, leaving you juggling payments every month? What…

Treasury bills in Canada are short-term government debt securities that mature within a year. As the Canadian government backs them, they are considered one of…

Alberta’s residents are facing the costliest auto insurance premiums in Canada, with litigation and legal fees twice as high as in Ontario. In recent years,…

Are you trapped in a life insurance policy that no longer aligns with your needs? Or is there a way to unlock its value and…