Best Mortgage Rates Toronto

When you want to buy a home in Toronto, finding the best mortgage rates Toronto can save you a lot of money in the long run. Toronto, one of Canada’s biggest housing markets, offers a

Maximum 4 project can be compared at one go.

The MAT (Municipal Accommodation Tax) is imposed on short-term rentals in Toronto. As a registered operator of short-term rentals, you need to assemble and put off 4 percent as a MAT on total rentals. As a short-term rental operator, you are required to collect the MAT tax as of January 1st. The payment will reflect as pending on a quarter-basis under 30 days later in the quarter period as per the below-given schedule.

| Period of Reporting | Due Date |

| 1st January to 31st March | 30th April |

| 1st April to 30th June | 30th July |

| 1st July to 30th September | 30th October |

| 1st October to 31st December | 30th January |

In order to collect and return the MAT on behalf of operators, short-period rental businesses can enter into an agreement for an elective collection with Toronto. Even if you did not rent out your short-term rental accommodation tax or decided to have your short-term rental firm gather and deposit the MAT on your behalf, you are still required to submit a report of the MAT for the entire reporting period. If you need assistance, please contact us by calling 311 for the Tax and Utility Inquiry Line. Below-given all the fields that are required unless specified as (optional):

To make sure your Municipal Accommodation Tax Report is correctly applied to your short-term rental property, please provide the information below.

The number will be given to you when you sign up for your temporary housing; Format: STR-0000-AAAAAA

| Ontario Driver's Licence |

| Ontario Photo Card |

| I am filing a new report |

| I am replacing a previous report |

Period of Reporting

| Q4 2023 (October 1 - December 31) |

| Q4 2023 (October 1 - December 31) |

| Q3 2023 (July 1 - September 30) |

A short-term rental is when all or a portion of a dwelling unit is made available for hire for fewer than 28 days straight. Bed and breakfasts (B&Bs) are included, but hotels and motels are not. Additionally, it excludes accommodations if no payment is made.

Note: Always go through your report before making a submission. All supporting paperwork, claims, and representations, as well as the information supplied in this application, are true and correct. This application will be examined and verified; erroneous, false, or misleading information may result in penalties, taxes, interest, and fees being charged to the account to which this application belongs. All supplemental materials must be retained for three years.

You can also follow the step wise guide on how to put together your report of Municipal Accommodation Tax:

You must also keep track of all transactions involving accommodations, including any income earned and any accommodations that might be granted during a reporting period.

After submitting a record of MAT online, you can use your registration number for short-term rental to pay via your financial institution using telephone banking, internet banking, an automated teller, or individually.

You are in charge of making sure the right amount of MAT is paid to the city. If you don't submit and pay for the MAT, the city may withdraw your registration number for short-term rental or refuse to renew it.

Only if you are a short-time rental operator registered for HST tax is the MAT subject to the tax. If your income from short-term rentals is less than $30,000, you do not need to register for HST. Learn more about HST online filing for vacation rentals in a new tab. Please see a sample MAT and HST calculation below if you are registered for HST:

The HST is not required to be paid to Toronto. In addition to your other payments of HST, you must pay this one to the agency of Canada Revenue.

From the day after the tax payment is delayed until the day on which the tax is fully paid, interest is charged on any overdue MAT payment at a monthly rate of 1.25%. After that, a 15% annual rate of interest on MAT will be charged on the principal amount due throughout the default term. All MAT payments that are declined by a financial organisation owing to insufficient funds will incur a $40 non-sufficient funds (NSF) fee.

When you want to buy a home in Toronto, finding the best mortgage rates Toronto can save you a lot of money in the long run. Toronto, one of Canada’s biggest housing markets, offers a

Pre-Authorised Payment ProgramsTo enrol in a Pre-Authorised Tax Payment Program (PTP), one must complete a Pre-Authorised Tax Application form. By enrolling in the program, the property tax bill payments are automatically deducted from your bank

For a government of any country, property taxes are one of the most practical ways to earn revenue. Every homeowner in Canada is entitled to pay their share of property tax. The income collected through

In Toronto, property taxes and Toronto utility bills can be paid online through the City of Toronto's website or in person at a ServiceToronto location. You can also pay by mail, phone, or through your

The Canadian housing market 2425 offers a variety of attractive locations for real estate investment, each with unique characteristics and

Do you also encounter difficulties understanding seller's permits and resale certificates? If yes, then worry not, as this is common

Purchasing and Constructing land in Ontario can be a daunting task. You never know what might happen. There are numerous

Canada's most notable and famous city, Toronto. Any individual planning to reside in Canada, this city is a preferred choice.

When it comes to Toronto, property transfer tax takes center stage during property transactions, encompassing both sales and purchases, even

Property taxes are charges or levies imposed by the local government for upkeep, infrastructure improvement, and educational purposes. They are

By requiring building inspections for permits and demolitions, as well as by looking into emergency orders and work done without

Canada is a beautiful country that is well-positioned and doing great on global surveys of progress, safety, and quality of

A Conditional Permit (CP) is a building permit issued where all the approvals were not received. CPs are used for

Since so long ago, Toronto, a city of towering buildings and legendary real estate masterpieces, has served its residents. When

Multi-tenant housing is when four or more people bunk together in one house and share the washroom and the kitchen

A tax is a mandatory financial charge or some different type of levy imposed on the taxpayer by a government

Toronto Property tax refers to the fee that residents of a country owe to their government. The amount of the

All properties in Ontario must be valued and assigned a classification by the Municipal Property Assessments Corporation (MPAC) Opens in

The Sign By-law, which lays out rules for signs used for business identification or promotional reasons, was passed by the

Toronto, the largest city in Canada, is situated on the northwestern shore of Lake Ontario. It is home to a

By requiring building inspection permits and demolitions for building, as well as by looking into emergency orders and work done

One of the most crucial steps in the building process is obtaining a building permit. A building permit is a

You must have seen organisations that choose to invest in real estate properties. Do you know what exactly the framework

Shifting is a global issue, especially for tenants with a travelling professional who needs to find a new settlement within

Are you dreaming of owning a home? A place to call your own? Buying a home is one of life’s biggest milestones, a mix of…

Gentrification in Canada stands for a term that captures the transformation of a neighbourhood through the influx of more affluent residents and businesses. It can…

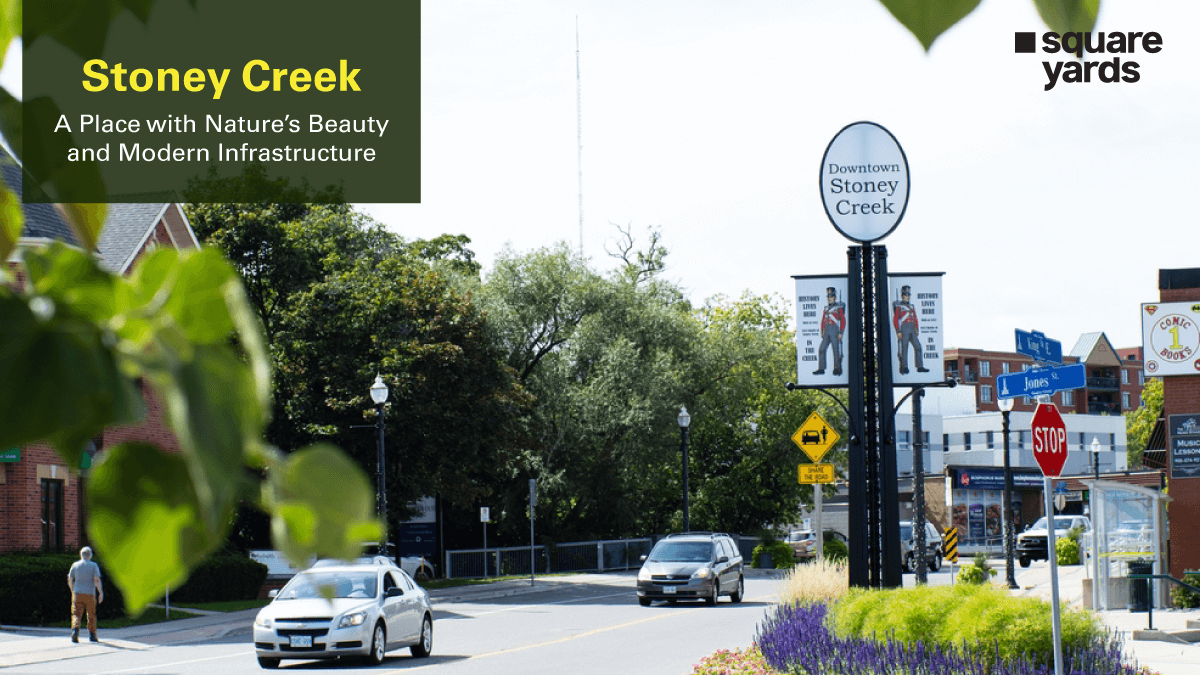

Tucked along the shimmering shores of Lake Ontario, Stoney Creek is where history whispers through scenic trails. Once a quiet village and now part of…

Are you a new condo owner? It must be an exciting step to have your own space. However, are you aware of the financial responsibilities…

If you're a landlord in Ontario, then you should know about the tenant eviction process. It is essential for managing your property effectively and staying…

Every trip to Montreal is considered complete with exploring the extraordinary underground city, called RESO Montreal Canada. It’s like a secret city under the streets,…

Burlington, Ontario, is where small-town charm meets urban energy, and every day feels like a page from your favourite novel. Burlington, located along the shores…

Are you ready to buy a home in Canada but torn between the appeal of brand-new construction vs resale homes property? It’s a big decision,…

When it comes to making home improvements, one of the first questions many homeowners have is, "When do I need a building permit?" It's a…

In the world of kitchen design, an island isn't just a stylish centrepiece. It's a pivotal element that can significantly enhance the functionality and flow…

Norfolk County is a treasure in Ontario, recognised for its breath-taking landscapes and rich past. It has beautiful beaches, charming villages, and green countryside, making…

Feeling trapped under the weight of multiple debts? Credit card balances, car loans, and personal loans piling up, leaving you juggling payments every month? What…

Treasury bills in Canada are short-term government debt securities that mature within a year. As the Canadian government backs them, they are considered one of…

Alberta’s residents are facing the costliest auto insurance premiums in Canada, with litigation and legal fees twice as high as in Ontario. In recent years,…

Are you trapped in a life insurance policy that no longer aligns with your needs? Or is there a way to unlock its value and…